Brochure Hsn Code And Gst Rate

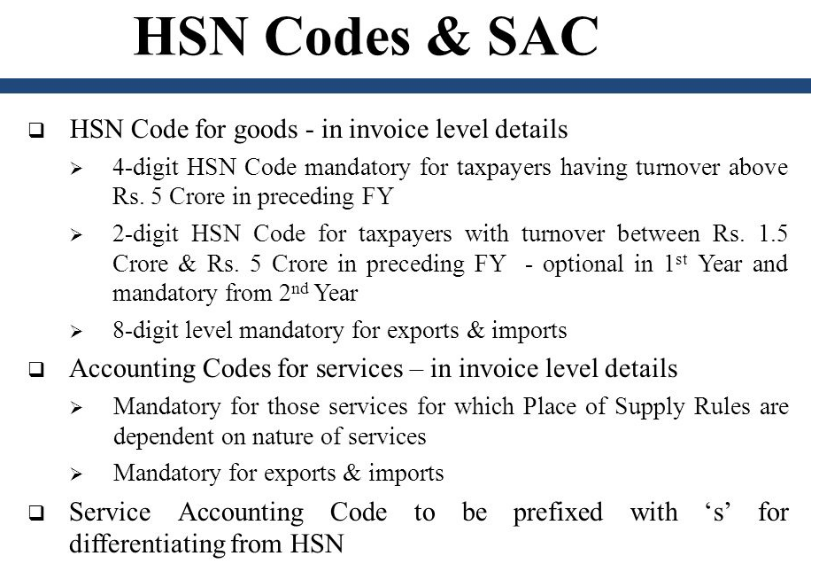

Brochure Hsn Code And Gst Rate - 5 % hs code : Dictionaries and encyclopaedias, and serial. Accurately classifying printed books, brochures, leaflets under the appropriate hsn code is crucial for several reasons: Explore categories, examples, and compliance for seamless. Dictionaries and encyclopaedias, and serial. Ensure tax compliance for your publications. Gst rates for hsn code 210. Hsn code 8901 classes the cargo ships as falling under a 5% gst rate which is the lowest tax rate ensuring the smooth freight. 5 % hs code : Find all hs codes or hsn codes for brochure printing and its gst rate with drip capital's hsn code finder. Otherwise, the rate is 0%. Dictionaries and encyclopaedias, and serial. Learn about the books hsn code, gst rates for books, brochures, and newspapers, and its importance. 5 % hs code : Gst rates applicable on hsn code 8485 1. Most printed books, including both educational textbooks and leisure reading materials like novels, are exempt from gst. 5 % hs code : What is the gst rate for cargo ships in india? Gst rates for hsn code 210. Common products under hsn code 4901 include educational textbooks, promotional brochures, art books, and informational pamphlets. Common products under hsn code 4901 include educational textbooks, promotional brochures, art books, and informational pamphlets. Gst rates in india are decided by the gst council and can be changed subject to suggestions and market. Promotional printed materials, such as brochures. Hsn code gst rate description; Gst rates for hsn code 210. Discover gst rates & hsn code 4901 for printed books, brochures, and leaflets. Explore categories, examples, and compliance for seamless. Identifying and mentioning accurate hsn code. Includes notebooks and similar items: 8 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 4901 printed. Gst rates for hsn code 210. Do much more than verifying hsn/sac codes with cleartax gst, india's most trusted billing and gst solution where reconciliation is made easy through intelligent inbuilt validations and tools. Finding the appropriate hsn code, such as the one for printed books, brochures, leaflets and similar printed matter, whether or not in single sheets, is. 17. 5 % hs code : 8 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 4901 printed. Otherwise, the rate is 0%. Discover gst rates & hsn code 4901 for printed books, brochures, and leaflets. Dictionaries and encyclopaedias, and serial. 5 % hs code : Discover gst rates & hsn code 4901 for printed books, brochures, and leaflets. Find all hs codes or hsn codes for brochure and its gst rate with drip capital's hsn code finder. Includes notebooks and similar items: Gst rates applicable on hsn code 8485 1. 5 % hs code : 8 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 4901 printed. What is the gst rate for cargo ships in india? 17 rows gst rates & hsn codes for printed books, newspapers and postal. Common products under hsn code 4901 include educational textbooks, promotional brochures, art books,. Learn about the books hsn code, gst rates for books, brochures, and newspapers, and its importance. Dictionaries and encyclopaedias, and serial. What is the gst rate for cargo ships in india? Do much more than verifying hsn/sac codes with cleartax gst, india's most trusted billing and gst solution where reconciliation is made easy through intelligent inbuilt validations and tools. Dictionaries. Discover gst rates & hsn code 4901 for printed books, brochures, and leaflets. Dictionaries and encyclopaedias, and serial. Find all hs codes or hsn codes for brochure printing and its gst rate with drip capital's hsn code finder. Gst rates applicable on hsn code 8485 1. Includes notebooks and similar items: Identifying and mentioning accurate hsn code. 5 % hs code : Find all hs codes or hsn codes for brochure and its gst rate with drip capital's hsn code finder. Gst rates for hsn code 210. What is the gst rate for cargo ships in india? Find all hs codes or hsn codes for brochure printing and its gst rate with drip capital's hsn code finder. Identifying and mentioning accurate hsn code. Learn about the books hsn code, gst rates for books, brochures, and newspapers, and its importance. Hsn code 8901 classes the cargo ships as falling under a 5% gst rate which is the lowest. Dictionaries and encyclopaedias, and serial. Find all hs codes or hsn codes for brochure and its gst rate with drip capital's hsn code finder. Gst rates and hsn code for printed books, brochures, leaflets. Otherwise, the rate is 0%. Products under the gst council system are assigned tax rates within five different categories which. Explore categories, examples, and compliance for seamless. Promotional printed materials, such as brochures. Common products under hsn code 4901 include educational textbooks, promotional brochures, art books, and informational pamphlets. Most printed books, including both educational textbooks and leisure reading materials like novels, are exempt from gst. Brochures, leaflets and similar printed matter, whether or not in single sheets Gst rates for hsn code 210. Discover gst rates & hsn code 4901 for printed books, brochures, and leaflets. Accurately classifying printed books, brochures, leaflets under the appropriate hsn code is crucial for several reasons: Includes notebooks and similar items: Dictionaries and encyclopaedias, and serial. Hsn code 8901 classes the cargo ships as falling under a 5% gst rate which is the lowest tax rate ensuring the smooth freight.HSN Code List and GST Rates 2022 (Updated)

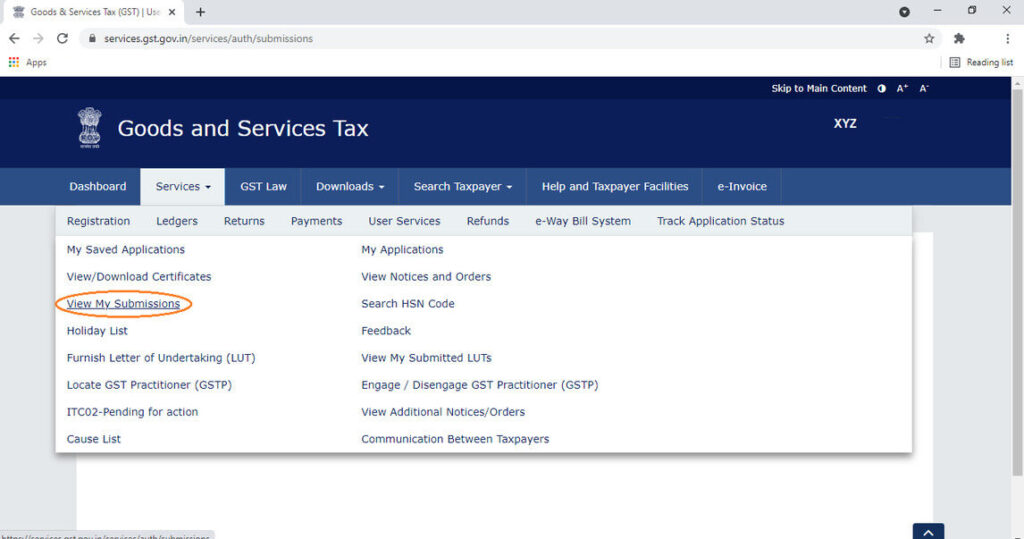

HSN Codes with GST Rates

HSN Code GST Rates for Books Everything You Need to Know

HSN Code List and GST Rates 2022 (Updated)

Stationery Items Gst Rate And Hsn Code at Ellis Brashears blog

Freight and Transportation HSN Code and GST Rate Nimbuspost

PRINTED BOOKS BROCHURES LEAFLETS GST RATES & HSN CODE 4901

Zinc Hsn Code And Gst Rate at Amanda Hamilton blog

List of HSN Code with Tax Rates GST EStartup India

GST Rates HSN Code on Printing Services, Newspapers & Brochures

Dictionaries And Encyclopaedias, And Serial.

Dictionaries And Encyclopaedias, And Serial.

Find All Hs Codes Or Hsn Codes For Brochure Printing And Its Gst Rate With Drip Capital's Hsn Code Finder.

Gst Rates In India Are Decided By The Gst Council And Can Be Changed Subject To Suggestions And Market.

Related Post: