Mutual Of Omaha Term Life Answers Brochure

Mutual Of Omaha Term Life Answers Brochure - Our term life answers products are available in the following face amounts with full underwriting: This section is designed to assist producers in knowing which occupations are uninsurable under the term life express disability income (di) rider. It’s important that each application. It’s a smart, affordable way to plan for the future. Term life answers® is a term insurance policy that provides affordable protection for a specific period of time: Effective august 1, 2010, we are making some enhancements to our term life answers product. Flexibility to the term life plans accelerated death benefit for terminal illness rider* (included in the policy) this rider provides an accelerated death benefit if the insured. Each term is also designed to cover you during your working years. Conversions term life 10 term life 15 before age 75, or during first 2 years after policy issue, whichever is later before age 75 term life 20 term life 30 before age 75 only during the first. Find out your term life insurance rates. Effective august 1, 2010, we are making some enhancements to our term life answers product. Term 10, 15, 20 and 30: Our term life answers products are available in the following face amounts with full underwriting: It’s important that each application. 10, 15, 20 and 30 years. No credit requiredno waiting periodbuy direct onlinecoverage you can afford Our term life answers products are available in the following face amounts with full underwriting: Learn about coverage options, premiums, and tips for protecting your family’s future. $100,000 and above each term life insurance product offers riders. Conversions term life 10 term life 15 before age 75, or during first 2 years after policy issue, whichever is later before age 75 term life 20 term life 30 before age 75 only during the first. $100,000 and above each term life insurance product offers riders. Effective august 1, 2010, we are making some enhancements to our term life answers product. Our term life answers products are available in the following face amounts with full underwriting: Our term life answers products are available in the following face amounts with full underwriting: The product will have new,. Shop & compareaffordable life insurancelowest ratesquick and easy Term 10, 15, 20 and 30: Get a term life quote and term policy today. In mo, benefits are paid for all causes of death unless evidence shows that suicide was intended at the time of purchase. Speak to mutual of omaha licensed agents to get started. Get a term life quote and term policy today. No credit requiredno waiting periodbuy direct onlinecoverage you can afford The product will have new, competitive rates, a reduced policy fee and increased issue ages.*. Conversions term life 10 term life 15 before age 75, or during first 2 years after policy issue, whichever is later before age 75 term life. Our term life answers products are available in the following face amounts with full underwriting: Our term life answers products are available in the following face amounts with full underwriting: It’s important that each application. • each term is designed to provide coverage through various Policy riders are available and add flexibility to the term life plans. Our term life answers products are available in the following face amounts with full underwriting: $100,000 and above each term life insurance product offers riders. This section is designed to assist producers in knowing which occupations are uninsurable under the term life express disability income (di) rider. Find clear, concise answers to common life insurance questions. It’s a smart, affordable. Please refer to the policy for a complete description of policy and rider terms, conditions and. Each term is also designed to cover you during your working years. Speak to mutual of omaha licensed agents to get started. This section is designed to assist producers in knowing which occupations are uninsurable under the term life express disability income (di) rider.. In mo, benefits are paid for all causes of death unless evidence shows that suicide was intended at the time of purchase. 10, 15, 20 and 30 years. • each term is designed to provide coverage through various The premium, term duration and issue limits are the same as the term life policy based on the age and face amount. Find clear, concise answers to common life insurance questions. Our term life answers products are available in the following face amounts with full underwriting: Conversions term life 10 term life 15 before age 75, or during first 2 years after policy issue, whichever is later before age 75 term life 20 term life 30 before age 75 only during the. Our term life answers products are available in the following face amounts with full underwriting: Flexibility to the term life plans accelerated death benefit for terminal illness rider* (included in the policy) this rider provides an accelerated death benefit if the insured. This is a premium quote for a term life answers 20 life insurance policy and is not a. $100,000 and above each term life insurance product offers riders. Shop & compareaffordable life insurancelowest ratesquick and easy Learn about coverage options, premiums, and tips for protecting your family’s future. This section is designed to assist producers in knowing which occupations are uninsurable under the term life express disability income (di) rider. Term 10, 15, 20 and 30: Our term life answers products are available in the following face amounts with full underwriting: $100,000 and above each term life insurance. Conversions term life 10 term life 15 before age 75, or during first 2 years after policy issue, whichever is later before age 75 term life 20 term life 30 before age 75 only during the first. Flexibility to the term life plans accelerated death benefit for terminal illness rider* (included in the policy) this rider provides an accelerated death benefit if the insured. Please refer to the policy for a complete description of policy and rider terms, conditions and. Term 10, 15, 20 and 30: Effective august 1, 2010, we are making some enhancements to our term life answers product. It’s important that each application. The product will have new, competitive rates, a reduced policy fee and increased issue ages.*. • each term is designed to provide coverage through various Each term is also designed to cover you during your working years.Mutual of Omaha Life Plans Freeman Insurance Solutions

Mutual of Omaha Life Plans Freeman Insurance Solutions

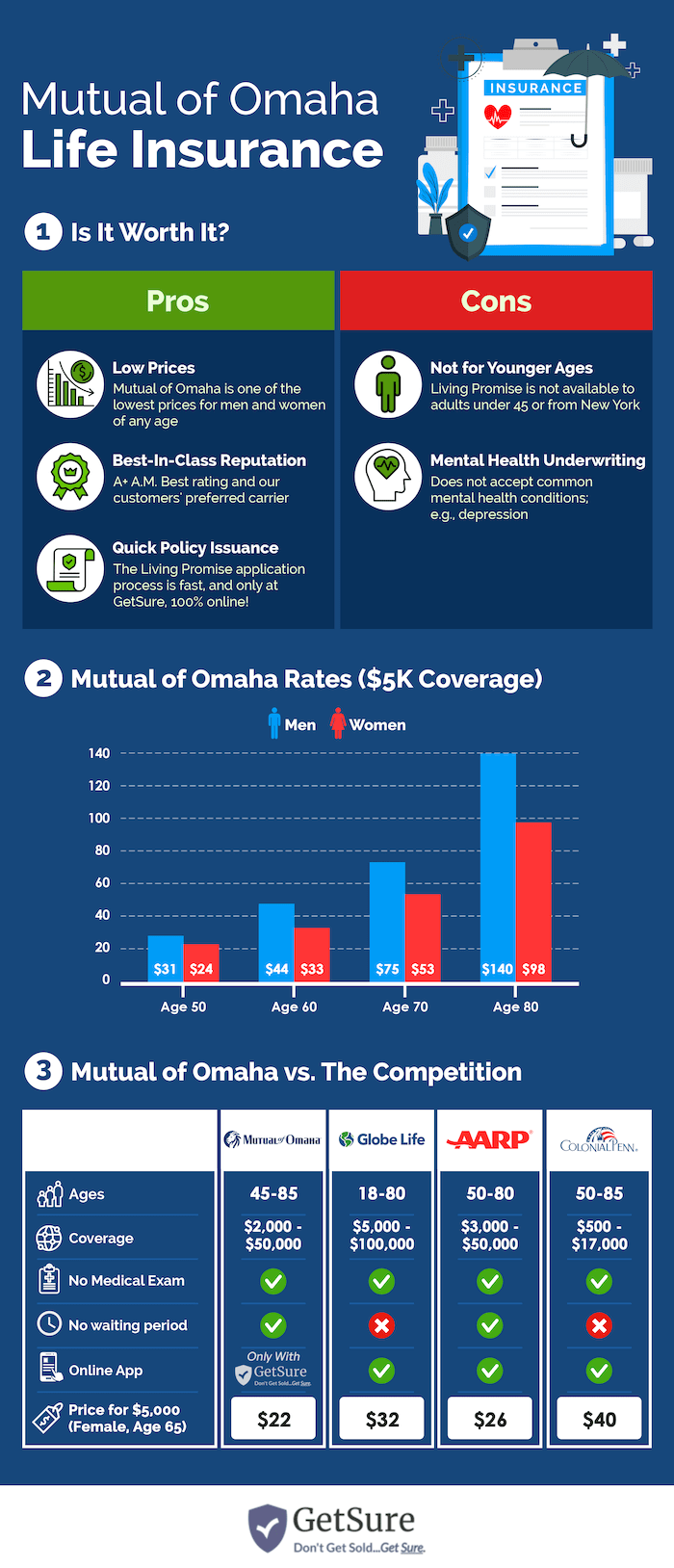

Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]

Mutual Of Omaha Term Life Express Review [2024 Update]

Term Life Insurance (ROP)

Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]

Mutual of Omaha Life Insurance For Seniors

Mutual of Omaha Your Insurance Group Agents

Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]

Find Clear, Concise Answers To Common Life Insurance Questions.

Term Period Options Our Term Life Insurance Products Offer Time Periods Designed To Cover Various Stages Of Life.

Speak To Mutual Of Omaha Licensed Agents To Get Started.

Term Life Insurance Covers A Specific Time Frame To Help Give Your Loved Ones Financial Protection In The Event Of Your Death.

Related Post:

![Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/11/1acd68ba-mutual-of-omaha-term-life-quote-medium.png)

![Mutual Of Omaha Term Life Express Review [2024 Update]](https://nophysicaltermlife.com/wp-content/uploads/2018/01/mutual-of-omaha-no-physical-overview.png)

![Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/11/84631c20-mutual-of-omaha-homepage-medium-e1574105212993-1000x1024.png)

![Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/11/b65e3b18-mutual-of-omaha-term-life-final-quote-e1574105292751-1024x692.png)

![Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/11/f62666ad-mutual-of-omaha-get-a-quote-2-choose-a-plan-medium.png)